Price inflation results from the expansion of the ‘money’, actually the currency, supply. We are told CPI inflation is the cause, but the latter is the result of expansion of fiat currency by the central banks who print it out of thin air. Beside CPI inflation is manipulated and cannot be trusted to produce anything reliable. See CPI Inflation is Total Fraud. This point is shown below.

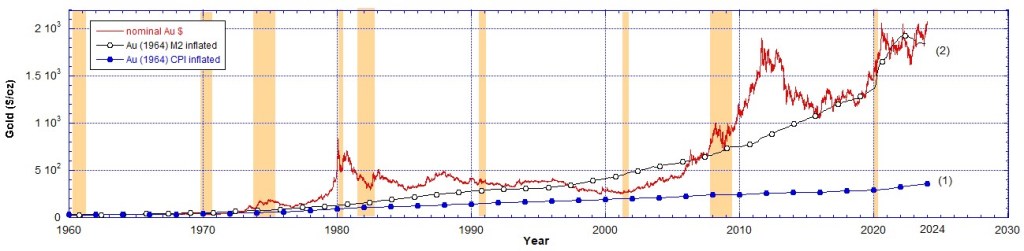

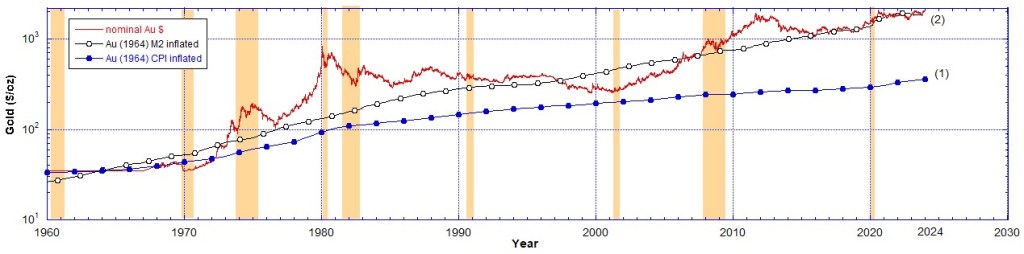

To illustrate the inflation effects, in the following two Charts 1 and 2, I have plotted inflation in the price of 1 oz of gold from 1964 when it was priced at $35.10 and compared that to the historical nominal price over the period shown. Curve (1) shows its price growth based on official government published CPI inflation and curve (2) is the price calculated from inflation due to the growth in the M2 currency supply as published by the Board of Governors of the US Federal Reserve.

In order to see the effects at the lower price levels a vertical logarithmic axis is better. The same data are plotted below in Chart 2 on log-linear axes.

On both Charts 1 and 2 it is quite apparent that the price of gold has kept up with the inflationary effects of expansion of the M2 currency supply (curve (2)). In fact, the price of gold after 2015 closely tracks the price of 1 oz of gold as inflated according to the M2 currency supply (curve (2)). Conversely the price indicated by CPI inflation (curve (1)) falls considerably short of the actual nominal price of gold.

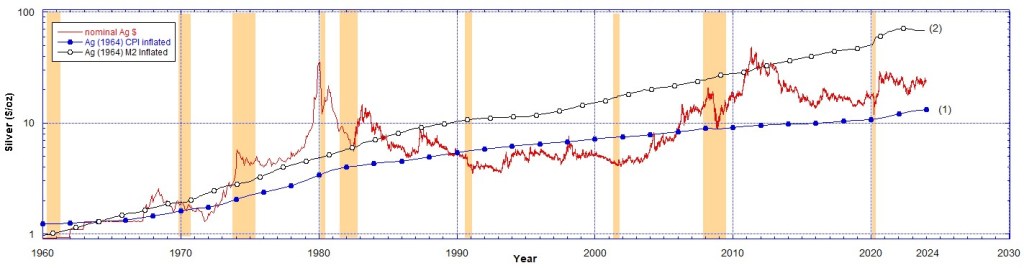

Similarly, in the following two charts, I have plotted inflation in the price of 1 oz of silver from 1964 when it was priced at $1.29, and compared that to the historical nominal price over the period shown. Curve (1) shows its price growth based on official government published CPI inflation and curve (2) is the price calculated from inflation due to the growth in the M2 currency supply as published by the Board of Governors of the US Federal Reserve.

Chart 4 presents the same data as Chart 3 but on a logarithmic vertical axis.

On both Charts 3 and 4 it is quite apparent that the price of silver has not kept up with the effects of expansion of the M2 currency supply (curve (2)). In fact, the price of silver after 1988 fell well below the price of 1 oz of silver as inflated according to the M2 currency supply (curve (2)) except briefly around 2012. The price indicated by CPI inflation (curve (1)) is a better match to the actual nominal price of silver, after 2008 it fell below the CPI price.

Silver has loss some of its luster. Because it is not so much a monetary metal but more of an industrial metal it has lost at least 50% of its true value over time. Gold however as a monetary metal, and a Tier 1 asset, has retained its true value against dollar devaluation caused by the mad money printing.

To correctly understand this I have stripped out the effects of the devaluation of the dollar from the M2 currency expansion and in Chart 5 and 6 below I show how gold has retained its purchasing power.

Statutorily gold was last priced at $42.222 in 1973. See What is Money? Who Controls It? Looking at the uninflated price of gold today (Charts 5 and 6) we see it is still priced around $42. This means in real terms the true price of gold has not changed much. This is easily seen once the effect of the expansion of the M2 currency supply is removed. However, from Charts 1 and 2 it is apparent that this cannot be said of CPI inflation. CPI inflation fails to strip out the effects of price inflation due to devaluation of the dollar. See also Chart 4 here.

Price inflation by expansion of the M2 currency supply when compared to the historical prices of gold and silver exposes the theft. This is the biggest and longest enduring theft possibly in modern human history. The ‘dollar ain’t worth the paper it’s printed on’ is coming to be true. And it looks like we are now on the verge of hyperinflation, but, as shown above, the real value of gold is unchanged. This is because gold is money, everything else is just credit.

Recommended Reading

- Book: Merchants of Death: Global Oligarchs and Their War On Humanity

- Book: Apocalypse Now: On the Revelation of Jesus Christ

Follow me

- Telegram.org: @GideonHartnett

- Facebook: Gideon Hartnett

- X (Twitter): @gideon195203

To be notified by email put your email address in the box at the bottom of your screen. You’ll get an email each time we publish a new article.

Click this image to make a secure Donation (Stripe) !