Recently Endgame Investor Rafi Farber wrote in his subscriber newsletter, under the heading ‘Beware of Wild 1978‘:

“What we have to be careful of, if we’re in 1978 and I think we are, is the fact that 1978 was a wild year for gold. 1978 was a good year for gold for sure, but there were two major, scary corrections [which can be seen on a daily chart]. Corrections will happen again, especially if it’s the hedge funds that are long. We still have one huge financial crisis to go before this thing blow[s] up. That is going to bring everything down, including gold, but gold will go down the least of all assets, just as happened in March 2020. After that’s over, we’ll be on a beeline to the End Game.

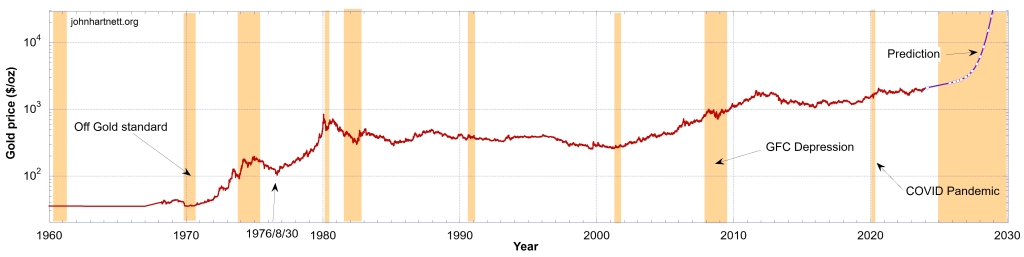

I decided to speculate on what the ‘beeline to the End Game could look like. As Rafi says it could be a wild ride before that starts, but I can model the ‘moon shot’ of the gold price once it starts.

We are talking about 1978 from which began a massive rise in the price of gold to the dizzying height of about $840/oz from $100/oz in 1976, a 8.4x increase. That happened only a few years after the gold window was closed. Perhaps a major reaction occurred as the price of gold was set free to rise and it went crazy wild. Well, what if a similar situation occurred soon?

It is necessary to compare ‘apples with apples’. Because the Federal Reserve has been ‘printing money’, creating credit since its inception, dollars start deflating as soon as they are created. Therefore by using the M2 money stock as published by the Fed we can calculate how to strip out the effects of price inflation on the gold price.

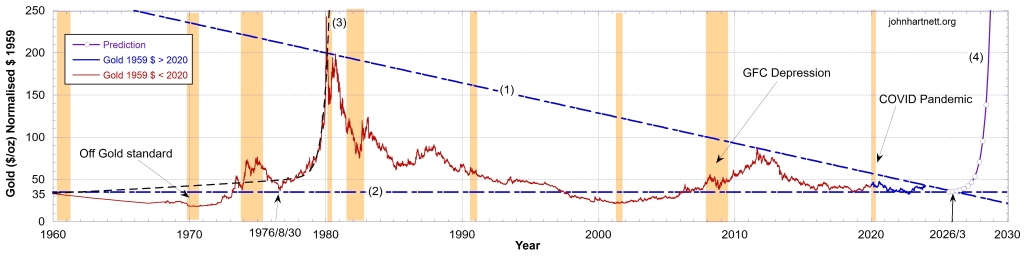

Chart 1 presents the M2 supply from which I calculated a normalisation curve such that $1 from 1959 deflates in value. This is shown in Chart 2 as curve (1) followed by curve (2).

This was then used to normalize the price of gold as shown in Chart 3.

You’ll notice that the gold price in normalised 1959 dollars is almost tracking horizontally (blue data, after 2020) which is headed into the apex of this triangle formed with the $35.10 price of an ounce of gold from 1959. The apex occurs sometime in March 2026 but what happens then?

If the powers-that-be lose control of the monetary system and nature takes over the Great Reset may not be as Klaus Schwab imagined. What if Rafi Farber’s prediction takes on the same break out as in 1978-80?

To model this I fitted an exponential curve to the data in the period 1977-1980 and translated it to fit the point of the 2026 apex in Chart 3. That is shown as the purple curve (4). But these values are still all in 1959 dollars. To get the current gold price in deflating current dollars I needed to multiply the 1959 dollar price of gold by the exponential curve (1) from Chart 2, but this time following its extension after 2024. The assumption here is that the Fed pivots sometime this year (2024) and cranks up the printing presses again. That means further exponential growth of the M2 money stock. The result is shown in Chart 4.

From 1976 when the price of gold touched a $100/oz to 1980 when it broke through $800/oz we saw a nearly order of magnitude increase. So I have assumed that a similar increase could occur in my crack-up-boom speculation. This is shown as the price increase according to the purple curve labelled ‘Prediction” in Chart 4. An order of magnitude increase means reaching $20,000/oz in 3½ years.

I don’t know when this will occur but it will eventually happen. It has to because the dollar is dying. Prepare accordingly.

Recommended Reading

- Book: Apocalypse Now: On the Revelation of Jesus Christ

- Book: Merchants of Death: Global Oligarchs and Their War On Humanity

Follow me

- Telegram.org: @GideonHartnett

- Facebook: Gideon Hartnett

- X (Twitter): @gideon195203

To be notified by email put your email address in the box at the bottom of your screen. You’ll get an email each time we publish a new article.

Click this image to make a secure Donation (Stripe) !