Entropy is a property of matter that is connected with how much energy is available to do work. As a system increases its entropy content its internal states all come into equilibrium exchanging energy until they are all at the same temperature. Only while there is a difference in temperature from one region to another can usable energy flow from the hotter regions to the cooler regions. This allows available energy to be extracted that can do work.

Big bang cosmologists apply this type of thinking to an expanding universe that allegedly originated in a singularity of zero dimensions. “Spontaneous creation of the universe from nothing” is the title of a 2014 Phys. Rev. D paper authored by He, Gao and Cai. Cosmologist Laurence Krauss even suggested the universe had an initial total energy content of zero. According to him as the universe expanded the kinetic energy and potential energy (including matter) remained in balance with a total net energy content of zero. A zero sum game.

Krauss’ book “A Universe from Nothing: Why There Is Something Rather than Nothing” is allegedly a non-fiction book that discusses modern cosmogony (that is the study of the origin of the universe) and its implications to the debate about the existence of God. His argument is that there is no God, no Creator as described in Genesis the first book of the Bible, but that the universe spontaneously arose out of some quantum vacuum fluctuation. I have discussed this concept previously but I won’t go into it here, except to quote Alan Guth, from the cover of the April 2002 issue of Discover magazine.

“The universe burst into something from absolutely nothing – zero, nada. And as it got bigger, it became filled with even more stuff that came from absolutely nowhere.”

How is that possible? Ask Alan Guth. His theory of inflation helps explain everything.

Now I segue from an inflationary physical cosmos to an inflationary monetary cosmos. The parallels are almost too good to be true.

As I previously alluded to the creation of the fiat credit/debt system is similar to the “… creation of the universe from nothing”. Both have no substance backing them. I can paraphrase Alan Guth without loss of meaning.

“The (fiat currency) universe burst into something from absolutely nothing – zero, nada. And as it got bigger, it became filled with even more stuff (credit and debt) that came from absolutely nowhere.”

Like Guth’s cosmological universe the fiat currency universe is ‘explained’ with inflation. The inflation in this case is the expansion in the currency supply through credit creation by the central banks and debt issuance by the other banks in a fractional reserve system.

Can we define entropy in the monetary universe? I believe we can.

A man’s labour produces goods which are something not nothing. While there is available energy, that is real money, real goods can be manufactured. This means even in a fiat system where dollars can still be exchanged for some gold (real money) there remains some energy to do work. But when the hyperinflationary system sets in and no one will exchange dollars anymore for gold the fiat monetary universe has reached a state of maximum entropy. The individual states of the system, the monetary units, have all come to the same ‘temperature’ which is absolute zero. ‘Temperature’ here is the value of the monetary unit priced in something real, like gold.

The hot big bang universe allegedly began in a high entropy state and as the universe expanded it cooled. Spontaneous order resulted as matter condensed out of the available energy as entropy decreased. That is a total fairy tale because entropy does not spontaneously decrease. But that is another story.

The fiat currency universe began in a low entropy state when dollars were exchangeable for gold but after the ‘epoch of decoupling’ from gold the fiat ‘printing’ exploded with a concomitant increase of entropy eventually ending in the hyperinflationary crack up boom.

In the big bang universe during the cosmic inflation era the inflation factor was of order 1026 over 10-36 seconds just after the beginning. Now that is absolutely hyperinflation. If you applied that to the devaluation of the dollar it would be worth 10-26 of its value from the initial 1914 creation of the Fed inflated currency. That is $1 would be worth 0.000 000 000 000 000 000 000 000 000 000 000 000 01 of a 1914 dollar. Or the price of an ounce of gold would be 1026 times its 1914 value in devalued dollars. But of course the dollars would be worthless and nobody would want them. That is equivalent to the cold death of the universe. It’s the cold death of the dollar.

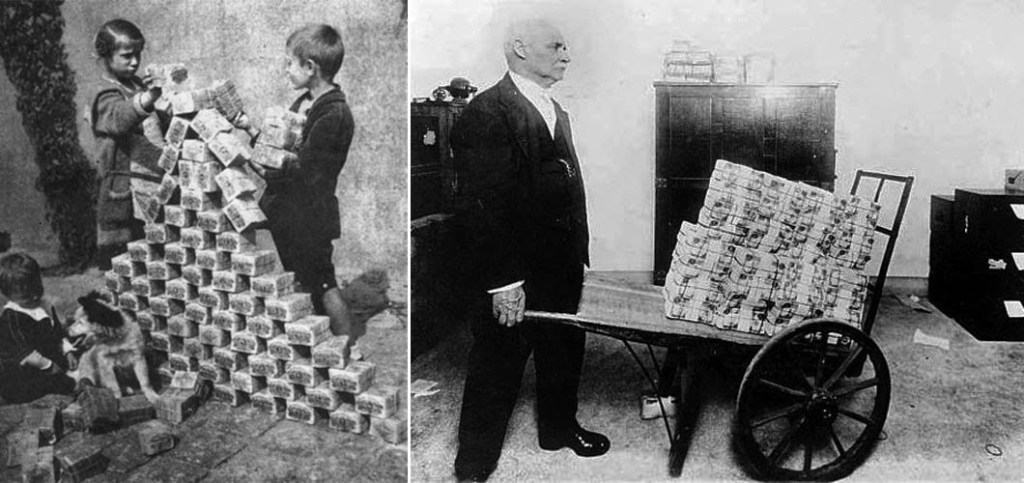

By late 1923, the Weimar Republic of Germany was issuing two-trillion mark banknotes and postage stamps with a face value of fifty billion marks. The highest value banknote issued by the Weimar government’s Reichsbank had a face value of 100 trillion marks (1014). At the height of the inflation, one US dollar was worth 4 trillion German marks. One of the firms printing these notes submitted an invoice for the work to the Reichsbank for 32,776,899,763,734,490,417.05 (3.28 × 1019, roughly 33 quintillion) marks.

The Penniless Billionaires, Max Shapiro, New York Times Book Co., 1980, page 203, ISBN 0-8129-0923-2

In July 1946 the Hungarian pengo (P) reached a monthly inflation rate of 4.19×1016 percent which meant prices doubled every 14.82 hours. The highest bank note denomination was 100 quintillion P (1020 P). By comparison the Weimar German Papiermark only reached 29,500 percent monthly in October 1923.

Hypothetically if we supposed monthly price inflation reached 1026 like cosmic inflation allegedly did (but not in the same time period), that means prices would double every 41.68 minutes.

We are not quite there yet, but all of the same concepts apply. The universal cosmic inflation allegedly started and stopped to get us to the current epoch. The financial controllers at the Treasury and Fed also speak of controlling inflation and engineering a ‘smooth landing’ instead of a crash. But it is just wishful thinking because the underlying system is based on nothing. Just like Krauss’ universe.

The real monetary system of gold as money does not suffer these problems. It is not inflationary, because the units of currency (money) only very slowly grow as they are mined from the earth. The units cannot be ‘printed’ on the keyboard of a computer, so monetary inflation is impossible.

I also believe that gold and silver are both primordial and intrinsic to the universe. They are intrinsic due to their creation by an intelligent Mind. They are something, not nothing! Contrast that with the creation of fiat currency, which is nothing, not something! Gold and silver are primordial because they were created at the beginning of the universe. They are largely impervious to decay, which means entropy has little effect on them. They are on the Table of Elements. They can be recycled and reconstituted over and over again. Fiat currency does not have this property nor does it have intrinsic value like these precious metals.

Fiat currency, bank notes and electronic units in deposit accounts or debt accounts, are inexorably subject to entropy of the monetary system and the dollar is devalued and the unit of exchange all come down to their intrinsic value, absolute zero. This means the death of the dollar is inevitable.

Recommended Reading

- Book: Apocalypse Now: On the Revelation of Jesus Christ

- Book: Merchants of Death: Global Oligarchs and Their War On Humanity

Follow me

- Telegram.org: @GideonHartnett

- Facebook: Gideon Hartnett

- X (Twitter): @gideon195203

To be notified by email put your email address in the box at the bottom of your screen. You’ll get an email each time we publish a new article.

Click this image to make a secure Donation (Stripe) !