Gold mining started almost 6000 years ago. The first reported case of it is found at the beginning of history, soon after God created man, Adam, and put him to work.

10 And a river went out of Eden to water the garden; and from there it was parted, and became into four heads. 11 The name of the first is Pison: that is it which compasses the whole land of Havilah, where there is gold; 12 And the gold of that land is good: there is bdellium and the onyx stone. … 15 And the LORD God took the man, and put him into the garden of Eden to dress it and to keep it.

Genesis 2:10-12, 15

God put gold in the Garden for Adam to mine. No doubt it was easily found and perhaps required no refining. Native gold is found in a pure form, often in nuggets. This gold was his reward for his labour, which eventually provided for a fair division of labour, as is recorded in history. Gold has been used as a money since that time. Money is the most liquid commodity. However it needs to have a store of value, which paper or plastic currency does not have.

The expression in Genesis 2:15 ‘to dress it and to keep it’ has the meaning of ‘to work and to guard or protect’. Thus Adam was the first labourer in his own garden provided by the Creator. The gold reward he received was good. This dispels the notion that the first humans just sat around and ate fruit from the trees and did nothing else. That would not be paradise. Humans were created to work and also to protect the fruit of their labour. This is what good stewardship means.

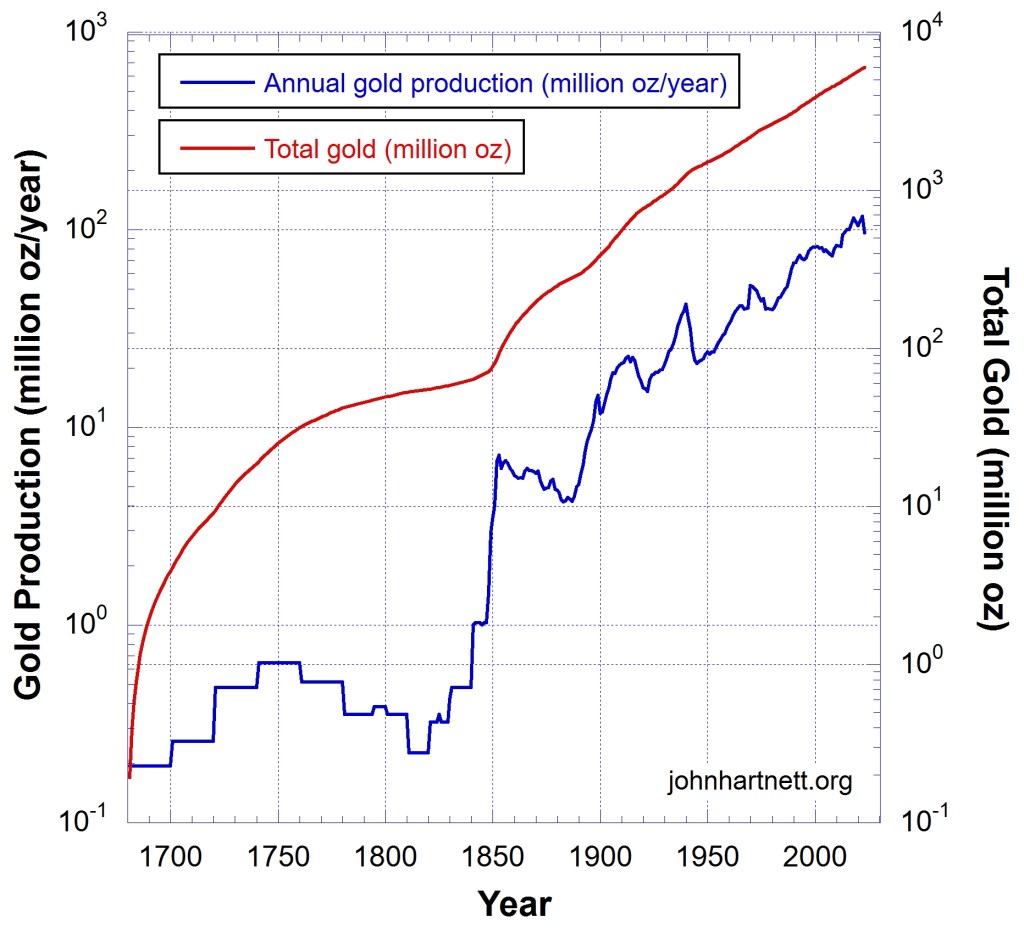

Kingdoms have come and gone but the gold many kings have conquered other nations for lives on. Most gold ever mined is still with us today. This is because gold does not ‘rust’ and decay away. As a result it has been used for enduring purposes especially for jewelry, the utensils of kings and money.

Except for that which has been lost (at sea or elsewhere) most survives today. Maybe it has been melted down and recast many times but it is still here. The total global amount above ground is currently estimated to be 6 billion oz (about 185,000 metric tons). See Chart 1 below.

Gold has been mined continuously since those early days but as technology has improved significant efficiencies have been achieved and lower grade ore has been made profitable. After 1850 annual production started to pickup, and particularly after 1900 there has been exponential growth in production. About 86% of all above ground gold has been mined in the last 200 years.

Some have suggested that globally we are approaching peak gold production and that as time passes we’ll see less mined per year. Chart 2 illustrates the annual production as a function of the total accumulation of gold. Since total accumulation does not decrease (gold is not destroyed) the latter is a good proxy for time.

In 2023 the total produced was 83% of that produced in 2022 as seen in Chart 2. But based on the fluctuations in production around the linear trend line (red dashed curve) it is too early to say that production has peaked.

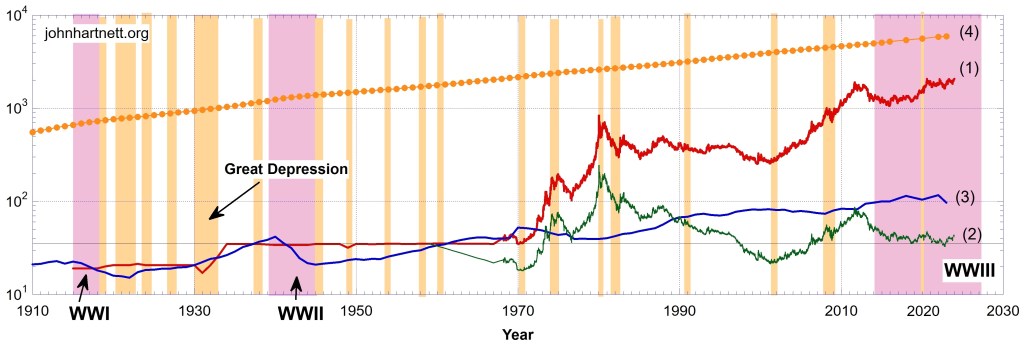

On Chart 3 I compare the production of gold against the gold price from 1915 to 2024. The red curve (1) indicates the nominal gold price which has been rising exponentially since 1971 when the exchangeability with dollars ceased. The background trend ignoring the big rallies are on an exponential trend line.

By using the US Federal Reserve M2 currency supply it is possible to strip out the effect of dollar devaluation and we get the green curve (2) from 1959. This represents the price of gold in 1959 dollars. Clearly there is no price inflation. Noteworthy is the fact that after about 2015 the price has followed the $35.1 price of gold closely though slightly above it, around $42. Interestingly that is the current statutory price, actually $42.2222. See What is Money? Who Controls It?

Consider the gold price in 1959 dollars (curve (2)) and the nominal gold price (curve (1)) before the gold window was closed, i.e. before 1971. Compare those data with the annual gold production (curve (3)). There may be a slight anti-correlation. When production was higher the gold price dropped. Notice during world wars WWI and WWII gold production dropped. It could be dropping now (in world war WWIII, since 2014 when the CIA started the Ukraine war) but it is too early to say.

One thing we can say is that the real uninflated price of gold has not declined as annual production has increased. Gold is money; everything else is credit! We understand that. It may be intrinsic to our nature because gold, and silver by extension, is given to us by God. It is real money.

God is not against wealth, but only hording it and depriving others of real wealth. That is exactly what the international banksters have been trying to do, this time over the past few hundred of years, with fiat currencies. They have used the fiat currency supplies to obfuscate the truth.

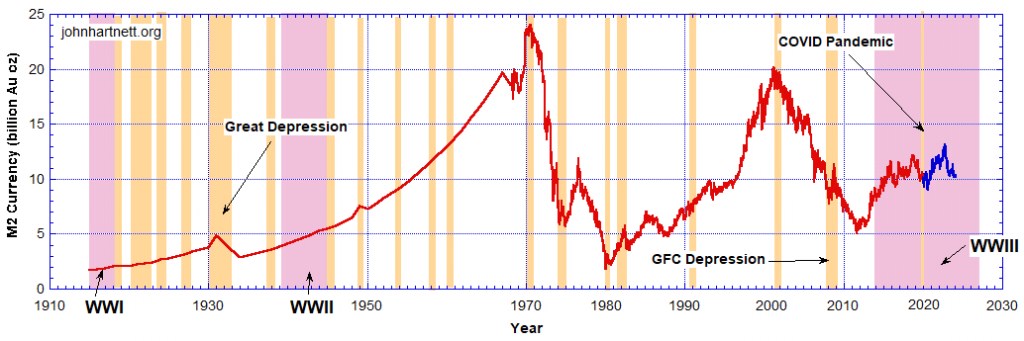

If we price the US Fed M2 currency supply in terms of oz of gold, we see something very striking. See Chart 4.

Gold is real money, which according to Austrian school thinking it does not change in value. This is God’s money. It is intrinsic money; real money. However fiat currency is the banksters’ ‘money’.

When we price the US M2 currency supply, which represents the global reserve currency, in ounces of gold we get the result as shown in Chart 4. This is generated by dividing the M2 supply by the nominal gold price per oz at each moment of time.

Historically M2 in gold oz has oscillated around 10 billion oz of gold but it reached a peak of 25 billion oz in 1970-71. That was just when decoupling of the dollar from gold was happening, after which the price of gold in dollars exploded and the M2 in gold oz dropped to the minimum in 1980 when the global total gold was 2.6 billion ounces above ground.

If US dollars were real money their total volume would accumulate according to the production of gold as it is dug out of the ground. That is the orange curve (4) in Chart 3. Quite clearly that is not the case. This is better seen in the following chart.

In Chart 5 we have the same M2 currency supply priced in terms of ounces of gold (red curve (1)) but now as a function of the total global accumulated gold. For comparison I have drawn in the expectation if only above ground gold was used as money (blue curve (2)). This means for every billion oz of gold mined a billion oz of M2 money is expanded. Of course gold is used for other purposes so the expansion of M2 should be below this blue line (2). Thus the blue line (2) is the upper limit for all real money on the planet, not just Federal Reserve currency. Any amount of currency above the blue line is unbacked by gold. The gold does not exist above ground to back it at 100% backing.

No matter how you slice and dice this the US Fed reserve currency is a fraud on a global scale. All fiat currency unbacked by gold is a fraud. And if you added all the other currencies of the world to the US M2 supply the result would be way worse than shown here.

Recommended Reading

- Book: Apocalypse Now: On the Revelation of Jesus Christ

- Book: Merchants of Death: Global Oligarchs and Their War On Humanity

Follow me

- Telegram.org: @GideonHartnett

- Facebook: Gideon Hartnett

- X (Twitter): @gideon195203

To be notified by email put your email address in the box at the bottom of your screen. You’ll get an email each time we publish a new article.

Click this image to make a secure Donation (Stripe) !