Argentina’s central bank holds bank reserves in excess of 300% of the country’s monetary base. The monetary base of a country is the sum of all currency in circulation plus the stored reserves held by the central bank. And as you might know Argentina has been living with massive price inflation somewhere around 100% but because most people use US Dollars as a method of storing their wealth the country’s monetary system does not completely collapse. See Why the Dollar Will Hyperinflate at Ludicrous Speed – RESERVE Currency in REVERSE

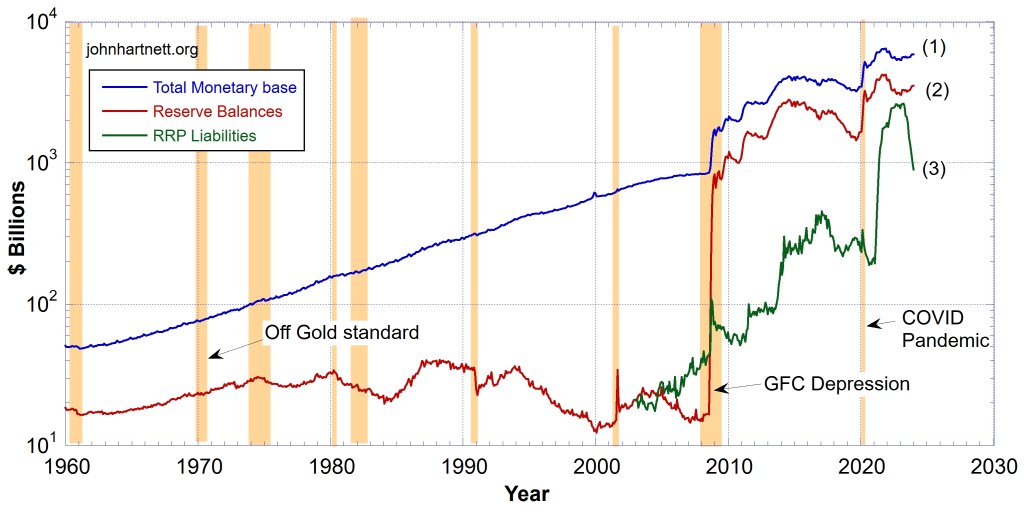

The US Total Monetary base, the Reserves held at the Federal Reserve central bank, and the Fed’s Reverse Repurchase (RRP) Agreement Liabilities are shown in Chart 1 below.

The Reverse Repurchase Agreement or Reverse Repo (RRP) Liabilities are the result of a facility only started after 2001. This also must be added to the Fed’s Reserves when calculating the liabilities it must pay interest on, after 2008 with waves of QE and when interest rates have really been increased.

Notice as the RRP Liabilities are falling in 2024 (green curve (3)) the Fed Reserves are moving up (red curve (2)). This means that currency is moving from the RRPs into the Reserves, via the banks. It is stealth QE in practice.

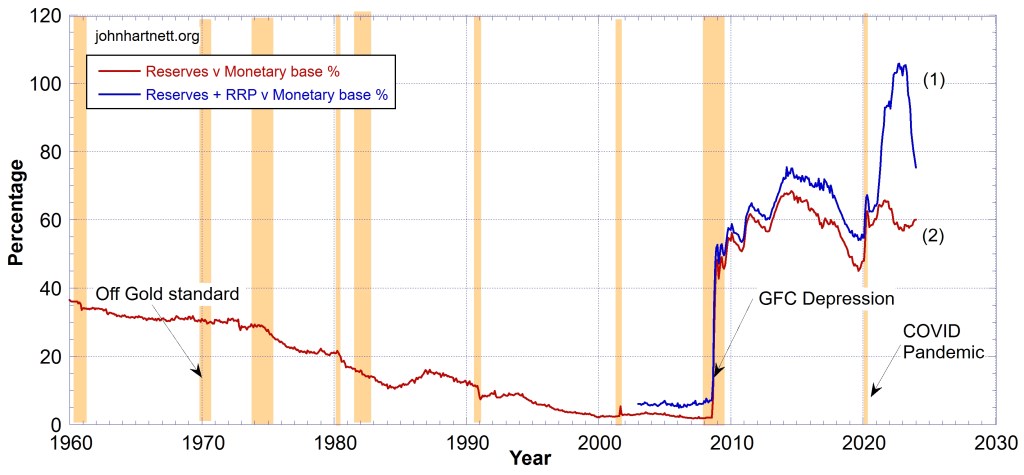

Chart 2 shows the Fed Reserve Liabilities as a percentage of it Total Monetary base (red curve (2)) as well as the percentage when the RRPs are added to the Reserves (blue curve (1)). During 2022 – 2023 this percentage rose above 100% reaching 105%. This makes it clear to see that this fiat currency is just debt. It is comprised of just IOUs. There is no real money there at all.

But it is not as high as the 300% of Argentina, yet! However the US Dollar is the world’s reserve currency, therefore there is no other currency below it, which can be used as a safe haven. Only gold and silver! The next wave of ‘mad money printing’ will push this way higher and I don’t think this is very far off.

As the next wave of massive credit expansion sets in, all currencies based on the US Dollar (which is all of them) will be affected and when the dollar dies so will all those currencies.

The monetary base is a component of a nation’s money supply. It refers strictly to highly liquid funds including notes, coinage, and current bank deposits. When the Federal Reserve creates new funds to purchase bonds from commercial banks, the banks see an increase in their reserve holdings, which causes the monetary base to expand.

The monetary base is a monetary aggregate that is not widely cited and differs from the money supply. But it is nonetheless very important. It includes the total supply of currency in circulation in addition to the stored portion of commercial bank reserves within the central bank. This is sometimes known as high-powered money since it can be multiplied through the process of fractional reserve banking.

Investopedia

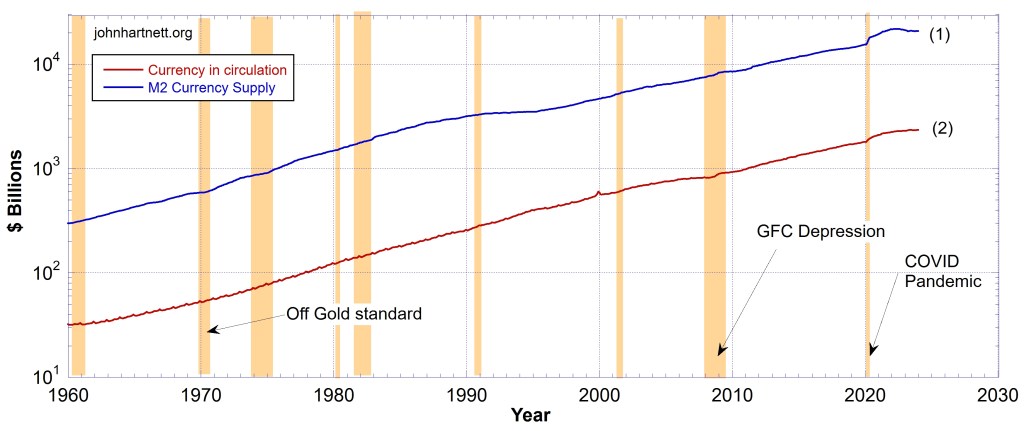

Chart 3 compares the currency in circulation (red curve (1)), the major component of the total monetary base, with the M2 money supply (blue curve (1)). The latter is 9 times the former. Both are increasing exponentially. That is a necessity in any fiat credit/debt based system.

The monetary base is most commonly divided into different categories (M0 through M3). The M1 money supply includes physical currency and reserves. It also counts demand deposits, traveler’s cheques, and other chequeable deposits. The M2 money supply includes all elements of M1 as well as near money, which refers to savings deposits, money market securities, mutual funds, and other time deposits. These assets are less liquid than M1 and not as suitable as exchange mediums, but they can be quickly converted into cash or chequeing deposits.

The Fed Reserves have amounted to about 60% of the Total Monetary base since 2012. See red curve (2) in Chart 2. The rest of it is the currency in circulation.

From Chart 3, we can see that the currency in circulation is only 11% of the M2 money supply. That is $2.3 Trillion compared to $20.8 Trillion in the M2 money supply. Most of the so-called ‘money’ is just electronic digits in some bookkeeping entry on a computer screen. It certainly isn’t real money. In my opinion, the only way to preserve some of your wealth in the coming financial apocalypse is by stacking real physical gold and silver. What is coming is biblical! I believe it!

Recommended Reading

- Book: Apocalypse Now: On the Revelation of Jesus Christ

- Book: Merchants of Death: Global Oligarchs and Their War On Humanity

Follow me

- Telegram.org: @GideonHartnett

- Facebook: Gideon Hartnett

- X (Twitter): @gideon195203

To be notified by email put your email address in the box at the bottom of your screen. You’ll get an email each time we publish a new article.

Click this image to make a secure Donation (Stripe) !