Was Monday a Black Swan? Looks like it was! All markets crashed after Japan started to unwind the carry trade when on July 31 the Bank of Japan raised interest rates from 0% to 0.25%. Other also factors, US unemployment report, added to the turmoil.

Fears that the U.S. is at risk of recession after Friday’s weak jobs report triggered mayhem across global markets. Tokyo’s Nikkei 225 plunged a staggering 12.4%, its biggest one-day percentage drop since October 1987, the Black Monday crash.

Traders, fearing that the Federal Reserve has waited too long to cut interest rates and that the economy is already in a downturn, flocked to the safety of U.S. government debt. The market’s so-called fear index surged to its highest level since 2020. A slowing economy would create challenges for companies’ earnings.

Stock Market News for Monday, Aug. 5, 2024: Stocks Tumbled Amid Global Selloff (Source)

The question is when will the FED pivot and cut interest rates? Some commentators have suggested that as soon as the Fed 17-18 September FOMC meeting they need to cut by at least 75 basis points.

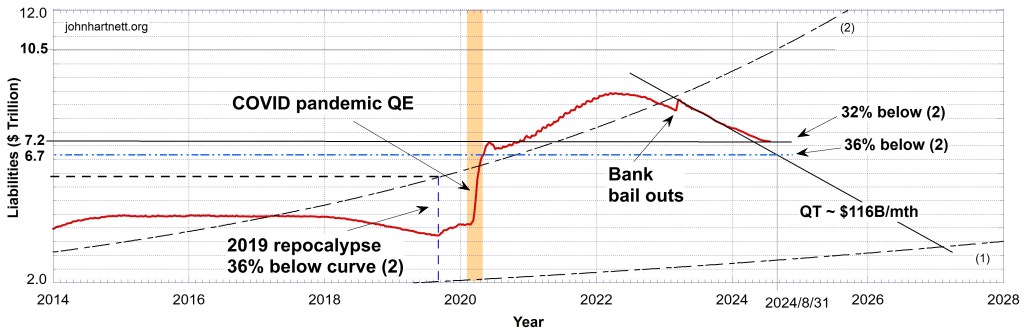

Last year I made a prediction of a date August 31, 2024, when this might happened based on Rafi Farber’s proposal, where he compared the quantitative tightening (QT) the Fed is now implementing to the QT period before September 2019, which led to the Repocalypse. By that time in 2019 the Fed liabilities, due to QT, had dropped 36% below the long term exponential growth trend line, curve (2) in Chart 1. Read When Will the Fed Pivot?

The prediction last year was based around this 36% figure being reached again soon. When Fed total liabilities are 36% below the trend line (2) the Fed should pivot and cut interest rates to prevent a massive market meltdown. Now I have updated the Fed liabilities data to see how we are progressing.

Last year the Fed was tightening at a linear QT rate of about $116 B/month as indicated, which would mean their liabilities would reach the point 36% below the exponential trend line (2) on August 31, 2024 as indicated. Of course there was no guarantee that that trend would continue, and it didn’t.

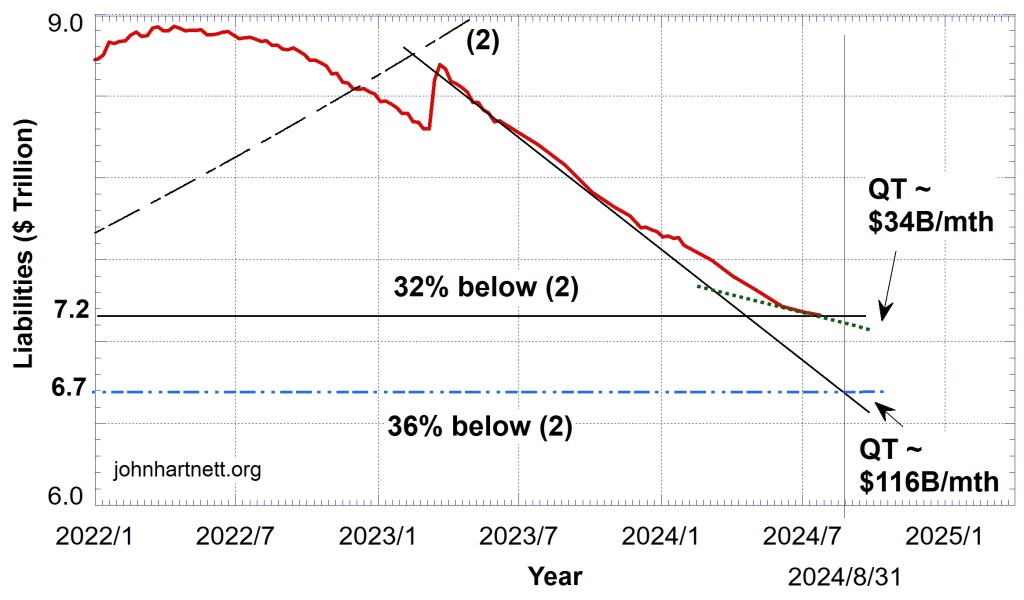

The following Chart 2 is the same data as in Chart 1 but zoomed in above 2022.

You can see the Fed has reduced the rate and currently they are tightening at a rate of $34B/month. Total liabilities have reached a point 32% below the exponential trend line (2). The rate of decrease has slowed significantly and at this rate it could take 6 more months to reach the 36% mark. Note the exponential trend line is still rising so even if the Fed stopped QT, in time the 36% mark would still be reached by February 2025. But with slow QT continuing the 36% mark would be reached sooner. (Thanks to Rafi Farber who alerted me to this fact.) But it is not an exact science, more of an art form, so just perhaps we are already there? I’d say anywhere between 32% and 36% would fulfil the criterium.

We talk about a black swan as a very rare and unexpected event. That has meaning if you live in the northern hemisphere but I live in Western Australia, which has the black swan as the state emblem. Here the black swan is common.

So just maybe the Fed cutting interest rates will soon become as common as the black swans in Western Australia, in their attempt to save the dollar from its final collapse in the coming Crack Up Boom. They don’t understand what money really is. In an attempt to save the markets crashing they must cut rates and print dollars like crazy (massive QE again) but that means hyperinflation and the dollar dies anyway.

Recommended Viewing

Recommended Reading

- Book: Apocalypse Now: On the Revelation of Jesus Christ

- Book: Merchants of Death: Global Oligarchs and Their War On Humanity

Follow me

- Telegram.org: @GideonHartnett

- Facebook: Gideon Hartnett

- X (Twitter): @gideon195203

To be notified by email put your email address in the box at the bottom of your screen. You’ll get an email each time we publish a new article.

Click this image to make a secure Donation (Stripe) !

2 responses to “Markets in Turmoil: Fed Must Pivot Soon”

More articles on the collapse of the USD in the coming Crack Up Boom, please. 😊

LikeLike

More coming as time permits

Did you see?

LikeLike